Purchasing ASIC Mining Hardware

Published

24.9.2024

Market timing is crucial for the success of your mining endeavour. At the peak of the bull market in November 2021, the popular Bitmain Antminer S19J Pro was sold for over $12,000. In the summer of 2024, these machines were selling for $600, a dramatic 95% drop in price. In this article, we'll highlight the essential aspects to consider when purchasing mining equipment. We’ll cover critical specifications, price drivers, cooling systems, and top manufacturers – helping you make an informed decision.

Table of Contents

Key Specifications of ASIC Mining Equipment

When purchasing an ASIC bitcoin miner, you should consider several critical factors to ensure you make a well-informed decision. First and foremost, you need to understand metrics like hashrate (TH/s), power consumption (W) and efficiency (J/TH).

Hashrate (TH/s)

Hashrate, measured in terahashes per second (TH/s), is a crucial specification that indicates the computational power of an ASIC miner. It refers to the number of hashes the machine can compute per second, with 'Tera' representing one trillion. For example, 1 TH/s equals 1,000,000,000,000 hashes per second. A higher TH/s generally translates to more computational power, which can lead to more bitcoin mined and in turn, revenue.

Power Consumption (W)

Power consumption, measured in watts (W), directly impacts your electricity costs. Lower power consumption leads to reduced operational expenses and higher profitability. When comparing two ASIC miners with the same TH/s output, the one with lower power consumption will be more cost-effective operationally.

Efficiency (J/TH)

Efficiency in ASIC miners is measured in joules per terahash (J/TH). Joules represent the total energy consumed, and a lower J/TH value indicates higher efficiency. Newer models typically offer better efficiency. For instance, the popular Bitmain Antminer S19J Pro operates at an efficiency of 30.5 J/TH, while the newer S21 boasts an impressive 17.5 J/TH.

Factory Specs vs Reality

When looking at the specifications of a miner it is always important to understand that these might deviate. In the spec sheet of most miners, it is indicated that a 5% deviation can occur. The manufacturers test the machines under perfect conditions, meaning the right ambient temperature, humidity level, altitude, and more. As shown below, the specs provided by Bitmain for the S21 are 3500 W and 17.5 J/TH at a temperature of 25˚c (77˚F). When ambient temperature is higher and the cooling systems cannot bring it back to 25˚c, the miner will likely consume more energy to produce the same hashrate and lose efficiency.

The Price ASIC of Mining Hardware Equipment

In order to understand if you are paying the right price for mining hardware, you need to understand the drivers of price, cost structure, and ASIC miners market cycles.

Drivers of Price

One of the primary factors driving fluctuations in the ASIC miner market is the price of bitcoin. When bitcoin's price rises, margins improve, and demand for mining equipment typically increases as more miners enter the market to capitalize on the higher BTC price. This surge in demand can lead to equipment shortages and rising prices. Conversely, when bitcoin's price falls, demand for mining equipment may decline, resulting in a surplus of equipment and lower prices.

Another factor influencing ASIC prices is mining difficulty. Bitcoin mining difficulty adjusts every 2,016 blocks – roughly 14 days – to maintain a consistent rate of block creation, affecting mining profitability. When the network hashrate rises, mining difficulty increases, reducing BTC revenue. This can decrease demand for mining equipment.

Finally, the availability of mining hardware also impacts the market. ASIC manufacturers regularly release new models, which can shift demand away from older models. Additionally, supply chain disruptions or production delays can affect the availability of mining equipment, leading to price fluctuations.

Cost per Terahash ($/TH)

Next to a price per unit, ASIC miners are often priced based on their hashrate output, expressed in dollars per terahash ($/TH). Some ASIC miner models come in variations with different TH/s outputs. For example the two primary hashrate outputs for the S21 are 200 TH/s and 188 TH/s. As a result, resellers and distributors frequently list prices in $/TH to standardize comparisons. The ASIC Price Index, which tracks the current prices of bitcoin mining ASICs across different efficiency tiers, also uses $/TH as a benchmark.

Premium for Efficiency

The newest and most efficient machines often sell at a premium. The better efficiency provides more profit and more protection to the downside while availability is still limited. The Bitcoin ASIC Price index below shows that this premium can fluctuate. Depending on how significant this premium is and what your operational expenses look like, it might be worth considering a lower capital expenditure per TH, as this can result in a shorter ROI in days.

De-coupling of BTC and ASIC Prices

In the period of 2020 - 2022, ASIC prices were highly correlated to BTC. In the beginning of 2023 there was also a response by hardware prices to bitcoin recovering back above the $20K level. Manufacturers, distributors, resellers, and miners realized that the bottom of the bitcoin market might be in, which led to an uptick in miner prices. While BTC kept on making moves to the upside throughout the 2023 and 2024, ASIC prices did not follow and continued to slide. The primary factor contributing to breaking the correlation with the bitcoin price is a substantial influx of machine supply into U.S. secondary markets. In 2023, this increase was largely attributed to defaults on equipment loans, asset sales, and corporate bankruptcies. In 2024 the impact of the halving on profitability has been the main driver for the pressure on ASIC prices.

Other Considerations Purchasing ASIC Mining Equipment

Cooling Methods for Bitcoin ASIC Miners

Efficient cooling is essential for maintaining the optimal performance of Bitcoin ASIC miners and preventing overheating. There are three primary cooling methods used in mining operations: air-cooling, immersion-cooling, and hydro-cooling. Each method has its own set of advantages and considerations, influencing factors like cost, efficiency, and infrastructure needs. The best choice will depend on the scale of the mining operation, budget, and environmental conditions.

The Bitmain S21 air- hydro- and immersion-cooled version.

To learn more about different mining cooling systems, infrastructure, and benefits and challenges associated with both, check out this article.

Lead Time

Lead time refers to the period between placing an order and receiving or deploying the mining machine. Since most ASIC miners are manufactured in Asia, shipping them to international markets can take time. The longer the lead time, the greater the opportunity cost, as you miss out on potential mining revenue. This is why some miners are willing to pay a premium for machines that are already in the country, at a facility, or even up and running

Spot vs. Future Orders

Due to production timelines, it’s common for existing models or new releases to be unavailable on the spot market. To secure equipment for future use, miners often place future orders. This strategy allows them to negotiate better prices since it guarantees manufacturers the sale of their upcoming production. However, a significant downside is that some manufacturers are notorious for production delays, which can impact when the machines are actually delivered.

Condition

In addition to new mining machines, there's a thriving market for used ASICs. When purchasing a used miner, it’s crucial to request a hash report that includes data on power consumption and the miner’s TH/s output. This is essential because used machines may have issues such as malfunctioning fans, faulty chips, or even a dead hashboard, leading to reduced performance compared to a new model.

Warranty

New units from most manufacturers come with a 12-month warranty. However, if a used unit is older than 12 months, this warranty no longer applies. The warranty is also voided if the machine is tampered with, such as by changing firmware, replacing parts like the control board, or submerging an air-cooled machine into dialectic fluids for immersion cooling.

Mining Equipment Manufacturers

There are various ASIC manufacturers to choose from. Bitmain (Antminer) dominates with a ~75% market share, followed by MicroBT (Whatsminer) with ~18%. Canaan (Avalon) is the third largest and the only manufacturer that is publicly traded. All these companies originated in China and produce in various Asian countries. MicroBT also assembles in the US.

In addition to the top three manufacturers, there are also alternative players starting to make a name in the ASIC miner market. One example is Auradine, a Silicon Valley-based company, who produces the TeraFlux miners which feature EnergyTune. This program allows for quick power adjustments without system rebooting. Both power and hashrate can be adjusted to the desired target, with the system automatically tuning accordingly. Another ASIC chip designer, DesiweMiner, was acquired by Bitdeer. The teams are now collaborating on the production of the SEALMINER.

In the fast-paced world of Bitcoin mining, new ASIC models are continually emerging, each offering higher hashrate output and improved efficiency. Staying informed on the latest developments is essential for timing your purchases strategically. By keeping up with market trends and technological advancements, you can gain a competitive edge, maximize profitability, and remain ahead in this rapidly evolving landscape.

THANK YOU NICO

We are thrilled to have him contribute to Braiins Blog and look forward to more pieces in the future.

Follow Nico on X @Smidnico, and find more info on his website.

Become a PUBLISHED AUTHOR with Braiins

We are looking for the best and brightest paid external contributors for the blog. Send us a direct message us on X with your ideas and become a published author—our top content might make it in our next book.

Categories

Be the first to know!

Most Recent Articles

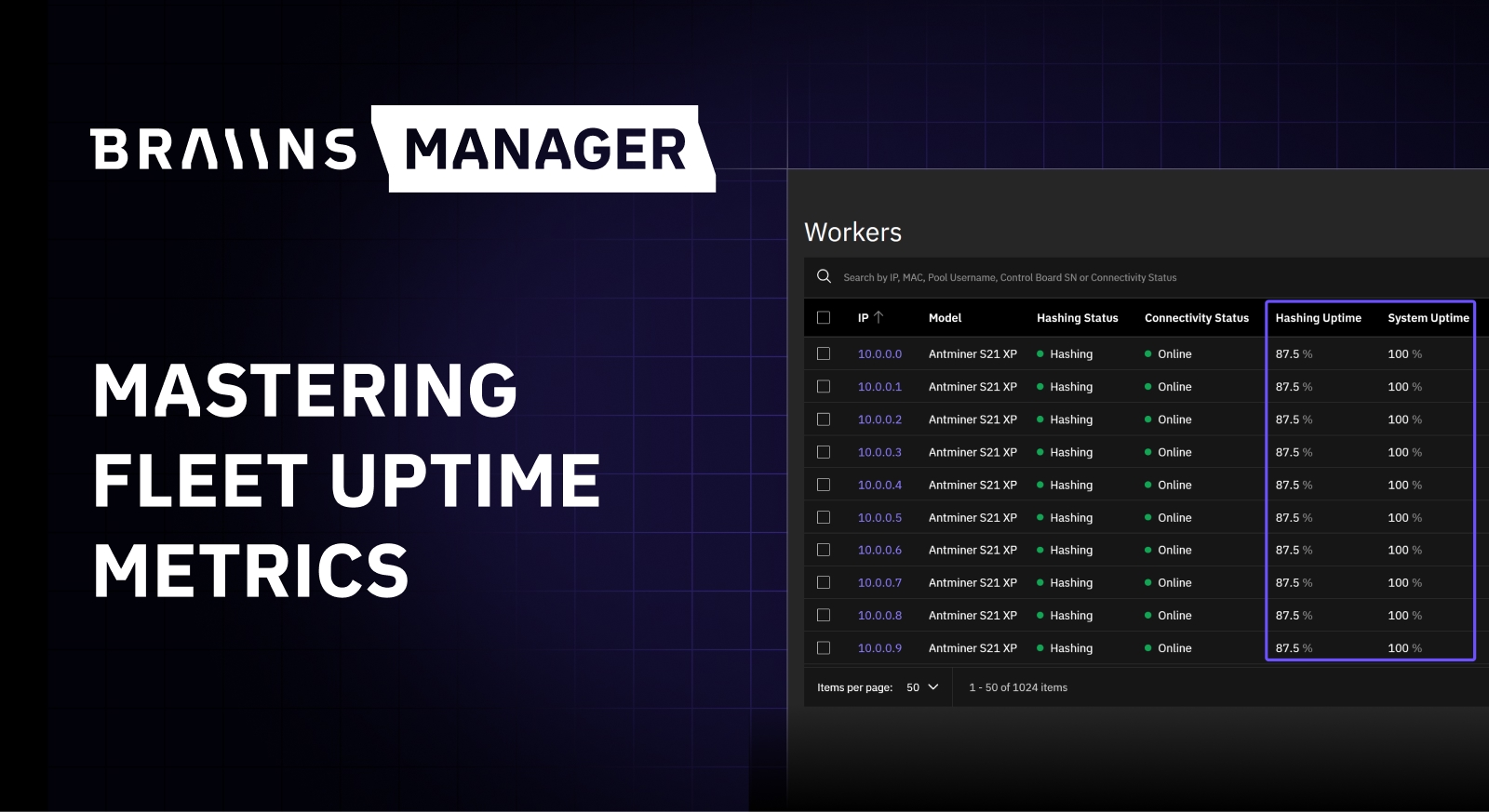

Beyond 100%: Mastering Uptime in Modern Bitcoin Mining

16.2.2026

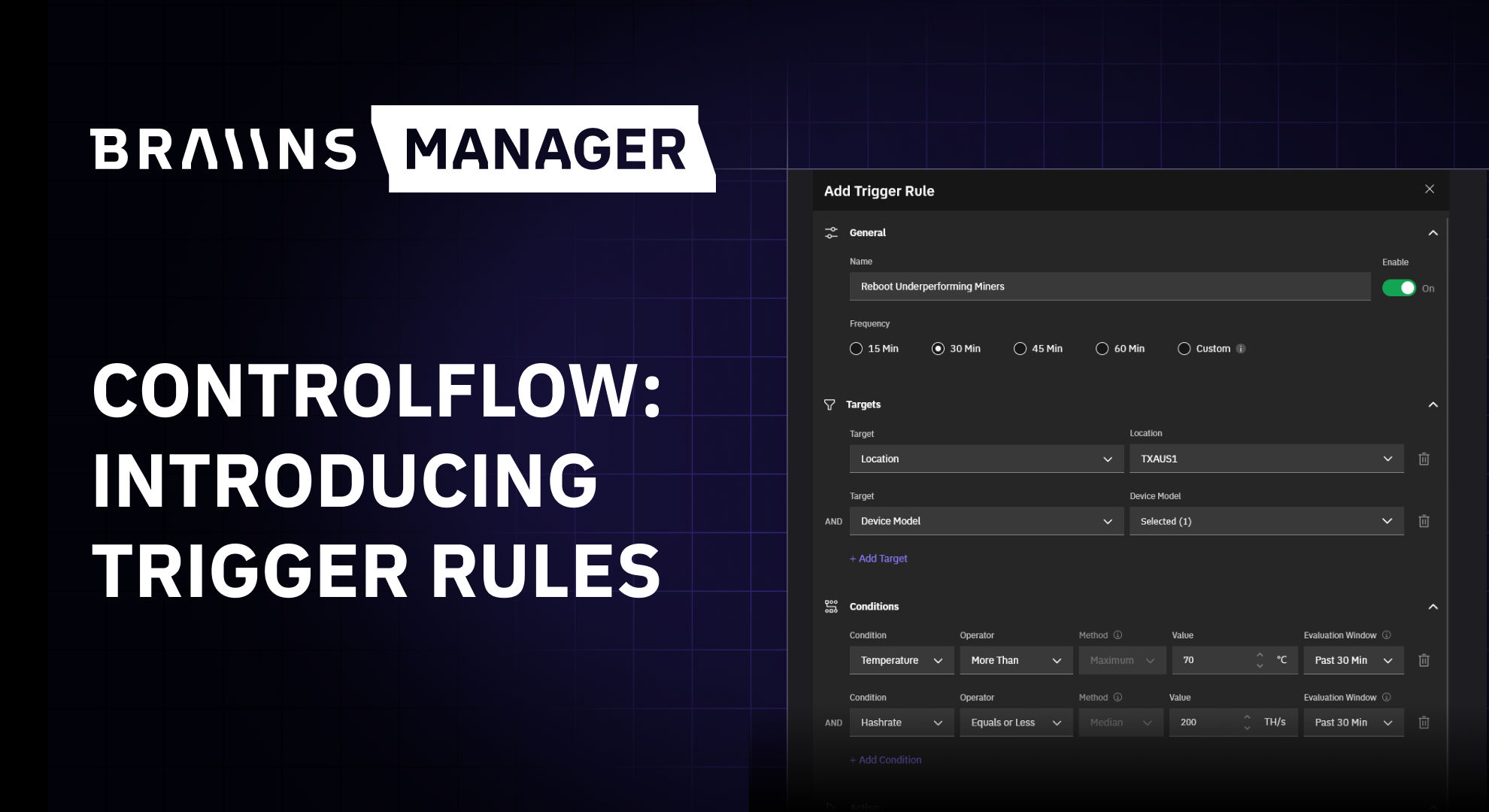

Controlflow Update: New Trigger Rules

21.1.2026